Critical Illness Cover

CIC is an insurance that pays out in the event of you suffering an illness that is classed as critical These illnesses are typically classed as:

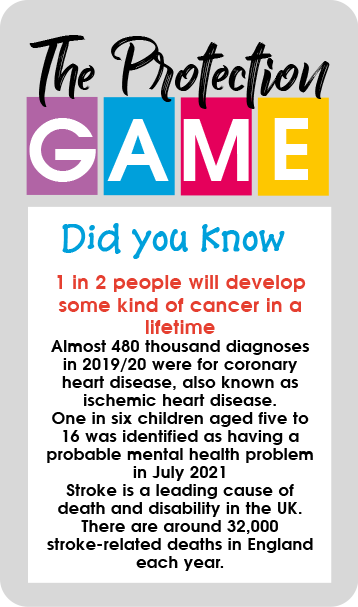

• Cancer

• Stroke

• Heart attack

There are however insurers that do have more critical illnesses covered such as Type 1 Diabetes, so what coverage you need is very dependent on your concerns.

Nobody wants to go to the doctor and get a diagnosis, only to then stress about how you are going to take time off to put your health first. It’s worth considering if you have a partner and they work, they may also need to take time off to support you.

You could look at a mortgage holiday as an option, but in truth, these do not last to the timeframes of your health, so this may be an insurance you feel relevant to put in place.

For a personalised chat to discuss your needs, that’s not going to cost you to be advised on what insurers and policies might work best for you just reach out to the contact details below