How the mortgage process works

- Application Stage: Applications are completed with the help of our Advisors. We are with you to help guide and support you every step of the way. We love good old fashioned human contact over the phone, or in person if possible…for those who wish to do everything online no problem simply complete the application forms we email to you to get the ball rolling

- The Mortgage Broker Magic: At this stage we search the market for the mortgage deals you will not find by searching yourself. This deal will be catered to the best of our ability to your personal needs and budget.

- The Stages of Application: There are many processes your application goes through before receiving a “yay or a nay”. The first stage is AIP an Agreement in Principle with the mortgage lender. Once we have this your mortgage application to the lender is submitted

A valuation is then instructed to be carried out at this stage on the property you wish to buy. This is carried out by a professional to estimate the value of the property to ensure it is in alignment with the loan value being taken out.

A process called Underwriting is now carried out by the proposed mortgage lender to assess how risky it will be to loan you the mortgage amount. In this process the lender will look at your credit history and score and look at how you are going to be able to pay back the amount borrowed.

Once the valuation has been received back and the offer accepted, we are full steam ahead into the final stages which are the “exchange” and “completion”

The Exchange Stage: This is the point when you the buyer and the seller are legally bound to complete the transaction of making the house your property. At this stage you the buyer pays a deposit to your solicitor – if either you the buyer, or the seller pulls out at this stage of completing the sale there are financial penalties

Completion Stage! This is the point where you the buyer has paid the seller with commonly a combination of your money and your agreed mortgage funds. This is the point where ownership of the property is passed to you – Hooray!

MTGE UK Fees

We will be paid a procuration fee from the lender.

For our advice services we charge a £99 fee however in certain circumstances such as extremely complex cases or where considerable time is spent sourcing and providing a recommendation a further fee will become payable

Where a fee payment has been agreed by all parties, this could equal 2% of the loan amount, however this will not exceed £5000.

Any such fee will be agreed at outset and an invoice issued prior to any application, advice or recommendation

Are you looking for a mortgage?

Get in touch to see how we can help

Mortgage Protection

So now that you have your home, we want to make sure you keep it!

This is the stage where our Mortgage Protection Team step up!

Once your mortgage has been agreed your broker will pass you onto the Mortgage Protection Team (expect to receive an email from our broker as an introduction). You will then receive a call or email from the Mortgage Protection Team duo

Our advisors will be in touch to discuss the following:

- Income Protection

- Life Insurance

- Critical Illness cover

- The call will only take 10 minutes

We ideally ask that you have details of any employer contracts and pre-existing insurance policies ready to look over in preparation for you call.

Why?

We want to make sure you have nothing to worry about should any unforeseen circumstances happen!

We look through the length and conditions of any accident and illness cover in your employer contract if employed, and check any pre-existing policies you may have to see if they work with the length and term of your new mortgage

Why again?

We’ve helped you in reality incur a debt, so morally in our eyes it only seems right that we would make sure you are protected

Quite often our clients wish us to search the insurance broker market to see if we can improve the cost and conditions of any pre-existing policies, they already have in place to see if we can get them a better deal. Anyone without insurance at this stage has the option of receiving a free quote in line with their personal circumstances and budget.

The follow-up stage. At this point you decide whether you wish to proceed with taking out any insurance policies under the professional guidance of an Insurance Broker. We do not charge you for this service, and the door is left open to you should you chose to change your mind to proceed at a later date.

Everybody who takes out an insurance policy with us has a free annual review with a specialist insurance advisor to make sure your policies are still working in alignment with your personal circumstances.

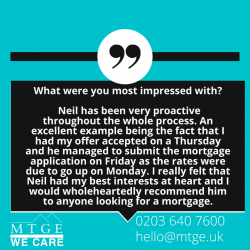

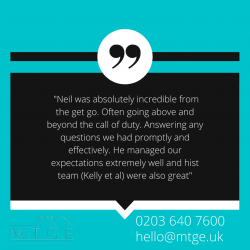

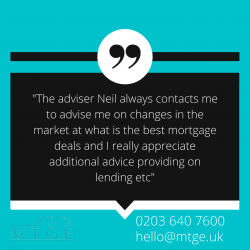

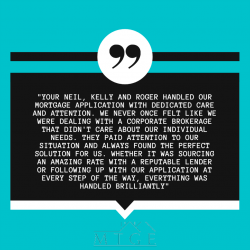

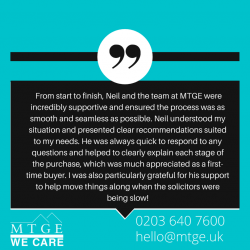

What our clients say about us.

Website design and build by RJB holdings